Theme

The mangroves depicted above symbolise resilience, demonstrating their ability to survive and grow in challenging environments such as saline waters, tidal zones and tropical coastlines. They protect shores, support diverse wildlife, enhance biodiversity and sequester carbon, playing a vital role in mitigating climate change. Their leaves excrete salt, while stilt-like aerial roots offer stability in muddy terrain and aid respiration, underscoring the importance of innovation for growth in competitive landscapes. Drawing inspiration from these marvels of nature, we continuously endeavour to evolve, elevate and transform our Company into a more resilient entity. We priorities long-term sustainability and lasting value in all that we do.

It is to the one who endures that the final victory comes.

- Gautama Buddha

About Atul

Our Company was founded by Kasturbhai Lalbhai on September 5, 1947 to create wealth in rural areas, generate employment on a large-scale and make India self-sufficient in selected chemicals (and thus igniting the spirit of self-reliance and laying the foundation for a brighter future for our country). It is the first private sector company of independent India to be inaugurated by its first Prime Minister, Jawaharlal Nehru, on March 17, 1952. Today, it is one of the largest integrated chemical companies in India. As a diversified enterprise and part of Lalbhai Group, one of the oldest business houses of India with a rich legacy, it caters to the needs of various industries. It has sustained through time and continues to evolve, driven by its deep-rooted Values and an ethos of sustainability.

Footprint

- Production facilities in India (Ankleshwar, Atul, Panoli and Tarapur)

- Subsidiary companies with production facilities in India (Ambernath and Atul) and the UK (Bristol)

- Joint venture entities with production facilities in India (Atul and Jodhpur)

- Wholly-owned subsidiary companies in Brazil (São Paulo), China (Shanghai), Ireland (Dublin), the UAE (Dubai), the UK (Wilmslow) and the USA (Charlotte)

- Distribution network of retail sales across India

- Sales of retail products in neighbouring countries

Manufactures 900 products and 400 formulations

Owns 140 brands

Serves 4,000 customers in 88 countries

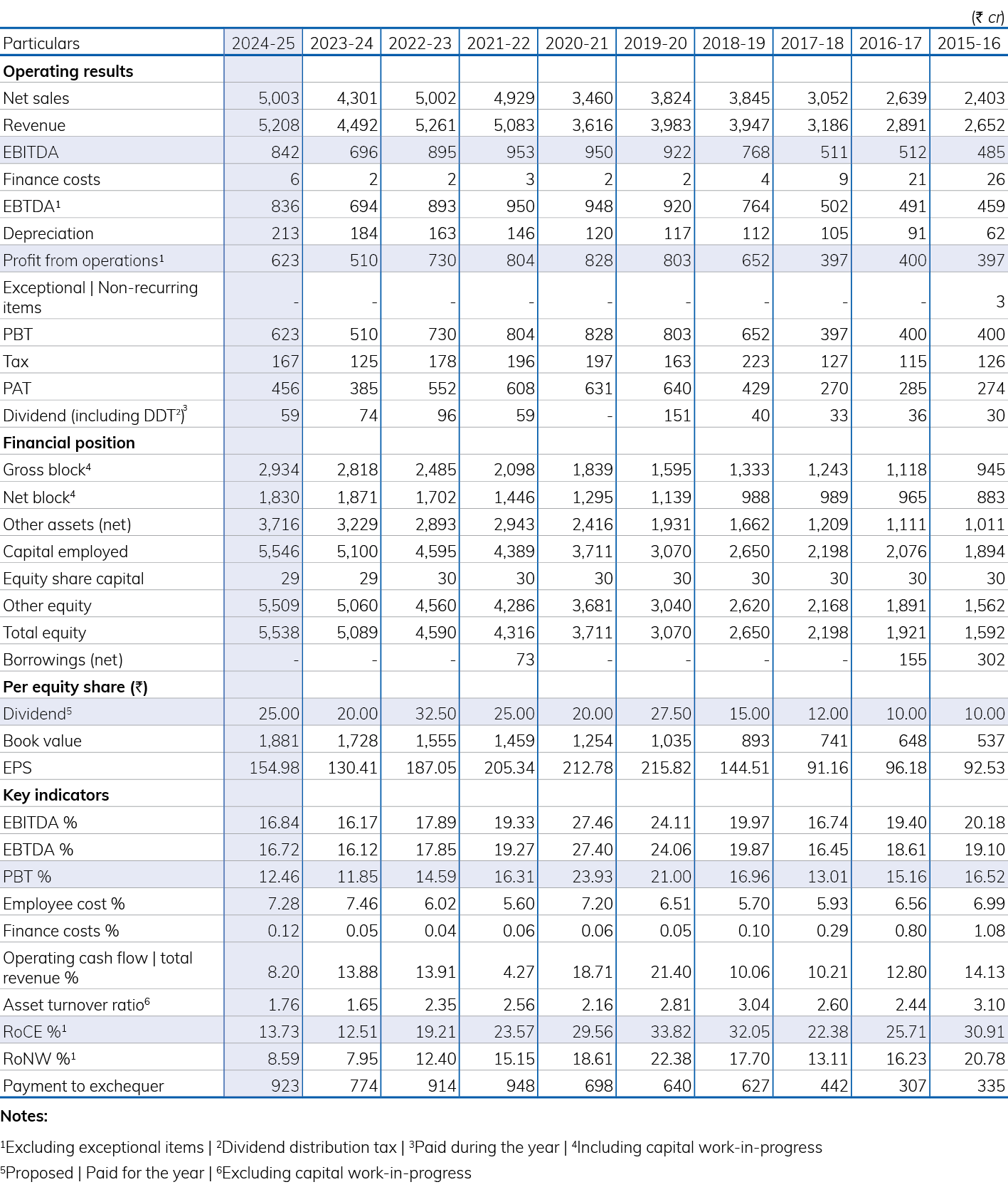

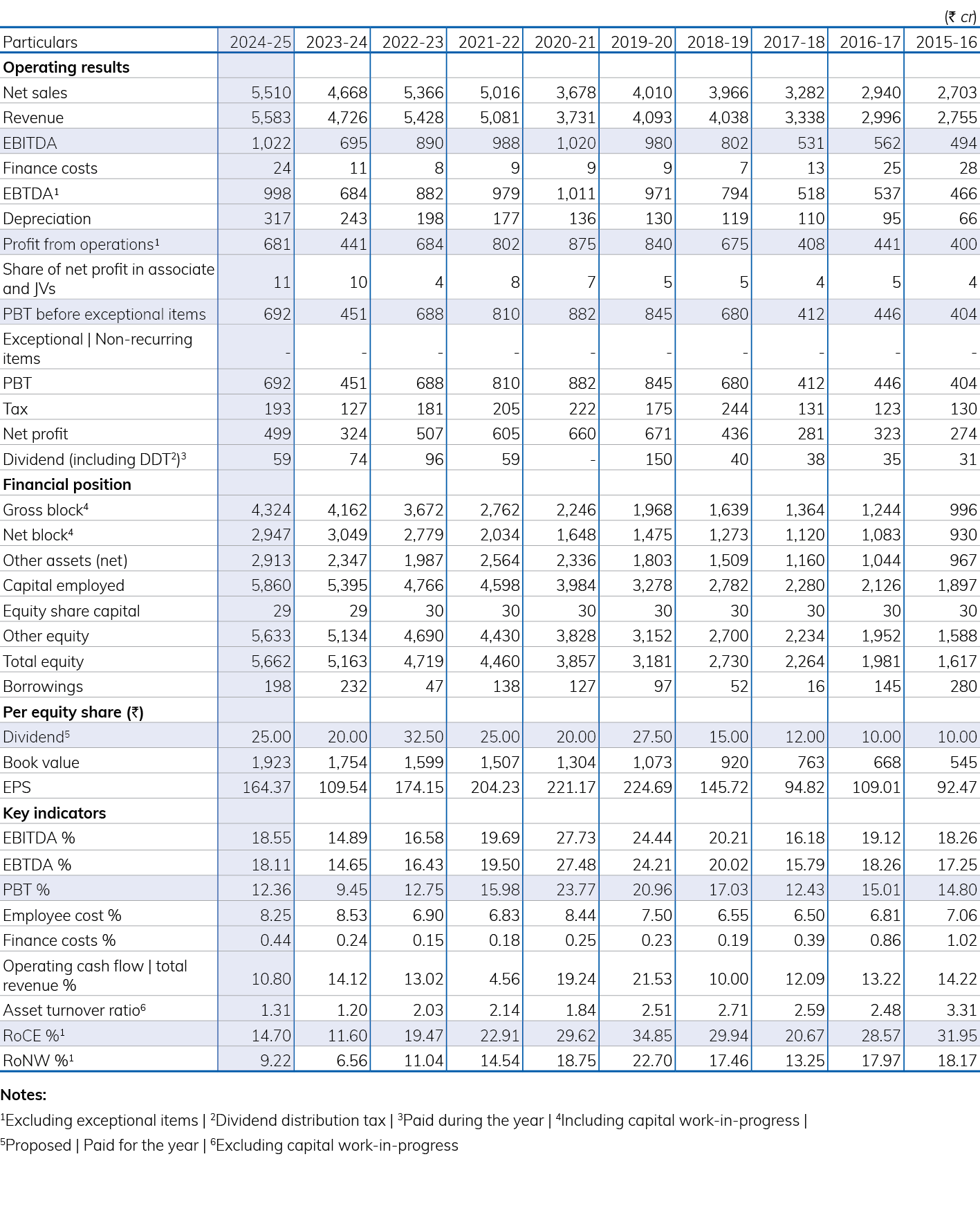

Performance at a glance

- Financial

- Non-financial

Financial

Financial*

₹ 5,583 cr

revenue

₹ 270 cr

capital expenditure

₹ 1,022 cr

EBITDA

₹ 25

dividend per share

₹ 692 cr

PBT

₹ 26 cr

savings through improvements in process efficiency

*consolidated financials

Non-financial

Non-financial

Environmental

7%

increase in renewable energy consumption

1,86,083 MT

waste recycled

88,468 tCO₂e

emissions decreased

Social

1,31,917

direct beneficiaries of CSR projects

44

CSR projects implemented

111

villages reached through infrastructure and conservation initiatives

Governance

no

cases of corruption and anti-competitive practices

no

instances of data breach

100%

adherence to Code of Conduct

Pillars of value creation

Our Company optimises the deployment of the six capitals across its operations to maximise value for its stakeholders.

-

Financial

capital -

Human

capital -

Intellectual

capital -

Manufactured

capital -

Natural

capital -

Social and

relationship capital

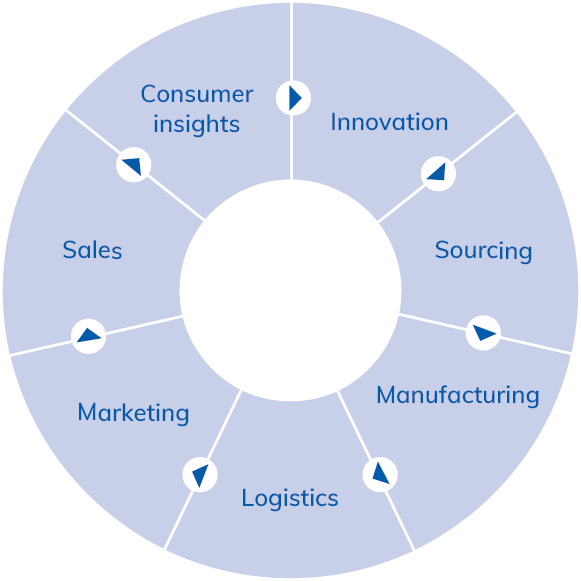

Value creation model

Financial Capital

- Net worth: ₹ 5,538 cr

- CapEx: ₹ 191 cr

- Borrowings (net): nil

Human capital

- Team strength: 3,359 members

- Training: 78,079 man-hours

- Safety training: 21,457 man-hours

Intellectual capital

- R&D laboratories: 10

- R&D expenditure: ₹ 41 cr

- R&D team strength: 242

Manufactured capital

- Manufacturing and production sites*: 8

- Manufacturing and production assets*: ₹ 3,024 cr

- Zero liquid discharge sites*: 5

Natural capital

- Total energy consumption: 78,10,518 GJ (of which 1,82,172 GJ is renewable energy consumption)

- Total water consumption: 45,70,869 kL

- Salt (washed) consumption*: 1,53,082 MT

Social and Relationship capital

- CSR amount spent: ₹ 13.59 cr

- No. of customers: 4,000

- No. of suppliers: 3,643

* consolidated basis

Businesses

-

Aromatics

-

Bulk Chemicals and Intermediates

-

Colors

-

Crop Protection - Bulk Actives

-

Crop Protection - Retail

-

Floras

-

Pharmaceuticals

-

Polymers - Performance Materials

-

Polymers - Retail

- Revenue: ₹ 5,075 cr

- PAT: ₹ 456 cr

- RoCE: 13.73%

- Rate of dividend: 250%

- Current leadership team that is homegrown: 74%

- Positions filled internally*: 34%

- LTIFR (permanent team members): 0.06

- Labour unrest: nil

- Amount saved because of of improvement in process efficiency: ₹ 26 cr

- New products developed: 46

- New formulations developed: 24

- Patents granted: 2

- No. of products: 900

- No. of formulations: 400

- Industries served: 30

- Countries served: 88

- Water intensity reduced: 10.5%

- Water harvested: 7,30,454 kL

- Waste recycled: 1,86,083 MT

- Value-added products from waste: 3

- CSR beneficiaries: 1,31,917

- Customer satisfaction score: 84%

- Procurement sourced from India: 81%

- Sourcing by value from suppliers with over 10 years of relationship: 48%

*consolidated basis

Consumers

We aim to provide superior quality products, formulations and services to our well-informed consumers to meet their expectations.

Customers

We supply our products to customers consisting of users and channel partners (distributors and retailers) to grow their businesses (and ours).

People

We aim to create a safe and happy environment, reward team members fairly and provide them with opportunities to learn and grow.

Suppliers and business partners

We partner with suppliers and business partners for our requirement of materials and services which in turn grow their businesses (and ours).

Planet

We aim to make the planet better by improving our operations and bringing down gaseous emissions, liquid effluents and solid wastes.

Government

We contribute to the exchequers, in India and outside, through our business operations and also undertake public-private partnership projects.

Society

We serve, in particular, the communities we operate in, and in general, the society, to make a difference in the lives of people.

Shareholders

We strive to deliver responsible, profitable and consistent growth for our shareholders, taking a long-term view.

Financial Capital

- Net worth: ₹ 5,538 cr

- CapEx: ₹ 191 cr

- Borrowings (net): nil

Human capital

- Team strength: 3,359 members

- Training: 78,079 man-hours

- Safety training: 21,457 man-hours

Intellectual capital

- R&D laboratories: 10

- R&D expenditure: ₹ 41 cr

- R&D team strength: 242

Manufactured capital

- Manufacturing and production sites*: 8

- Manufacturing and production assets*: ₹ 3,024 cr

- Zero liquid discharge sites*: 5

Natural capital

- Total energy consumption: 78,10,518 GJ (of which 1,82,172 GJ is renewable energy consumption)

- Total water consumption: 45,70,869 kL

- Salt (washed) consumption*: 1,53,082 MT

Social and Relationship capital

- CSR amount spent: ₹ 13.59 cr

- No. of customers: 4,000

- No. of suppliers: 3,643

* What we depend on

Businesses

-

Aromatics

-

Bulk Chemicals and Intermediates

-

Colors

-

Crop Protection - Bulk Actives

-

Crop Protection - Retail

-

Floras

-

Pharmaceuticals

-

Polymers - Performance Materials

-

Polymers - Retail

- Revenue: ₹ 5,075 cr

- PAT: ₹ 456 cr

- RoCE: 13.73%

- Rate of dividend: 250%

- Current leadership team that is homegrown: 74%

- Positions filled internally*: 34%

- LTIFR (permanent team members): 0.06

- Labour unrest: nil

- Amount saved because of of improvement in process efficiency: ₹ 26 cr

- New products developed: 46

- New formulations developed: 24

- Patents granted: 2

- No. of products: 900

- No. of formulations: 400

- Industries served: 30

- Countries served: 88

- Water intensity reduced: 10.5%

- Water harvested: 7,30,454 kL

- Waste recycled: 1,86,083 MT

- Value-added products from waste: 3

- CSR beneficiaries: 1,31,917

- Customer satisfaction score: 84%

- Procurement sourced from India: 81%

- Sourcing by value from suppliers with over 10 years of relationship: 48%

*consolidated basis

Consumers

We aim to provide superior quality products, formulations and services to our well-informed consumers to meet their expectations.

Customers

We supply our products to customers consisting of users and channel partners (distributors and retailers) to grow their businesses (and ours).

People

We aim to create a safe and happy environment, reward team members fairly and provide them with opportunities to learn and grow.

Suppliers and business partners

We partner with suppliers and business partners for our requirement of materials and services which in turn grow their businesses (and ours).

Planet

We aim to make the planet better by improving our operations and bringing down gaseous emissions, liquid effluents and solid wastes.

Government

We contribute to the exchequers, in India and outside, through our business operations and also undertake public-private partnership projects.

Society

We serve, in particular, the communities we operate in, and in general, the society, to make a difference in the lives of people.

Shareholders

We strive to deliver responsible, profitable and consistent growth for our shareholders, taking a long-term view.

Stakeholder engagement

We actively engage with stakeholders who not only influence the business, but also those who are impacted by the operations of our Company.

The business model of our Company places stakeholders at the core, ensuring that their evolving needs and expectations guide our decision-making. This approach fosters trust, safeguards stakeholder interests and strengthens relationships built on mutual respect and shared growth. Through continuous engagement, we address stakeholder priorities, integrate their insights into strategic planning and drive sustained value creation across the short, medium and long-term.

Materiality assessment

Materiality assessment serves as the foundation of the environmental, social and governance (ESG) initiatives for our Company, enabling us to identify and prioritise issues that are significant to the business and stakeholders. By engaging with diverse stakeholders across the value chain, we gain valuable insights into evolving priorities, ensuring that the ESG initiatives are relevant to and aligned with their expectations. This sharpens our understanding of material topics and strengthens the ability to deliver on identified ESG priorities and enhances the relevance and impact of the efforts taken towards those initiatives.

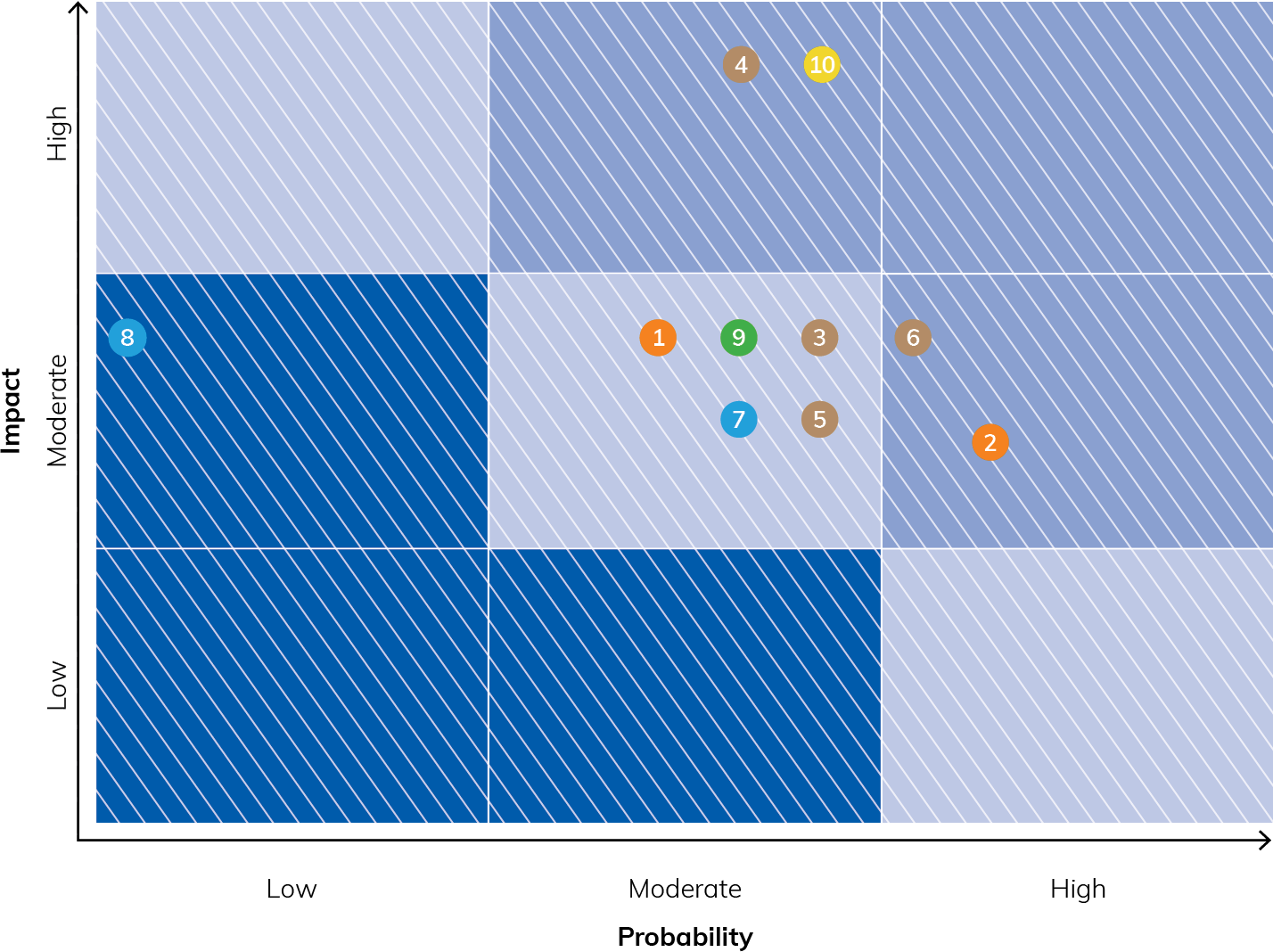

Risk management

Key risks

- 1Digitalisation risk

- 2Geopolitical risk

- 3Business performance risk

- 4Cyber risk

- 5Supply chain risk

- 6Talent risk

- 7Compliance risk

- 8Adverse regulatory risk

- 9Sustainability risk

- 10Safety risk

Risk categories

- Strategic

- Operational

- Regulatory

- Sustainability

- Reputation

ESG action report

Our Company is committed to embedding environmental, social and governance (ESG) principles into its business operations. Sustainability has always been a core focus and we view ESG as the key driver of long-term stakeholder value and a means to improve the quality of life in the communities we serve. Materiality is central to the business strategy of our Company and thus through structured stakeholder engagement, we identify and prioritise ESG issues material to the business and ecosystem. This section offers a comprehensive overview of the ESG commitments, actions and their impacts.

Environmental

Our Company has been sensitive to the environment since its inception. The natural forest created at the first site makes it one of the greenest chemical complexes of its kind in the world.

Social

Our Company is committed to creating a positive social impact since its founding 78 years ago. We place the communities, people, supply chain partners and other stakeholders at the center of all that we do.

Governance

Transparent and ethical governance forms the foundation of the business strategy and shapes the organisational culture with strong corporate governance practices.

Board of Directors

Committees of the Board

- Audit Committee

- Nomination and Remuneration Committee

- Corporate Social Responsibility Committee

- Risk Management Committee

- Investment Committee

- Stakeholders Relationship Committee

- C Chairperson

- M Member

- M

- M

- C

- M

Sunil Lalbhai

Mr Sunil Lalbhai is a Managing Director since June 1984 and the Chairman of the Company since August 2007.

Mr Lalbhai holds a postgraduate degree in Chemistry from the University of Massachusetts and a postgraduate degree in Economic Policy and Planning from Northeastern University.

Samveg Lalbhai

Mr Samveg Lalbhai is a Director since January 2000 and a Managing Director of the Company since December 2000.

Mr Lalbhai holds a graduate degree in Commerce from Gujarat University.

Bharathy Mohanan

Mr Bharathy Mohanan joined the Company in August 1992 and was a Whole-time Director from January 2009 to May 2025.

Mr Mohanan holds a graduate degree in Engineering (Honours) from the University of Calicut.

- M

- M

Gopi Kannan Thirukonda

Mr Gopi Kannan Thirukonda joined the Company in October 1993 and is a Whole-time Director since October 2014. He is currently the Chief Financial Officer of the Company.

Mr Thirukonda holds a graduate degree in Science from the University of Madras and a postgraduate diploma in Management from the Indian Institute of Management, Ahmedabad. He is a Member of the Institute of Chartered Accountants of India, the Institute of Cost and Management Accountants of India and the Institute of Company Secretaries of India.

Mukund Chitale

Mr Mukund Chitale was a Director of the Company from October 2014 to October 2024. He is a founder of the Chartered Accountancy firm, Mukund M Chitale & Co.

Mr Chitale holds a graduate degree in Commerce from the University of Mumbai and is a Member of the Institute of Chartered Accountants of India.

Shubhalakshmi Panse

Ms Shubhalakshmi Panse was a Director of the Company from March 2015 to March 2025. She was the Chairperson and Managing Director of Allahabad Bank Ltd.

Ms Panse holds a postgraduate degree in Science from Savitribai Phule Pune University and a postgraduate degree in Business Administration from Drexel University and is a certified Associate of the Indian Institute of Bankers.

Baldev Arora

Mr Baldev Arora was a Director of the Company from April 2015 to March 2025. He was the Chairman of Cyanamid Agro Ltd and the Chairman and Managing Director of Wyeth Lederle Ltd.

Mr Arora holds a graduate degree in Mechanical Engineering from Panjab University.

- C

- M

Pradeep Banerjee

Mr Pradeep Banerjee is a Director of the Company since May 2022. He was an Executive Director on the Board of Hindustan Unilever Ltd (HUL), the Managing Director of a joint venture entity of HUL in the Netherlands and the Chairman of a joint venture entity of HUL in Nepal. He is a senior advisor to Boston Consulting Group and a Designated Partner in Pradeep Banerjee Associates LLP.

Mr Banerjee holds a graduate degree in Chemical Engineering from Indian Institute of Technology, Delhi.

- M

- C

- M

Rangaswamy Iyer

Mr Rangaswamy Iyer is a Director of the Company since May 2023. He was the Finance Director and Managing Director of Cyanamid and Wyeth India Ltd. Currently, he advises Lincoln International, USA and consults multiple firms on business strategy and development.

Mr Iyer holds a postgraduate degree in Commerce and a postgraduate degree in Financial Management from the University of Mumbai.

- C

Sharadchandra Abhyankar

Mr Sharadchandra Abhyankar is a Director of the Company since October 2023. He is a Senior Partner at Khaitan & Co and is engaged with the NSE Center of Excellence, UPES School of Law, Government Law College, Mumbai and the Department of Law at Mumbai University.

Mr Abhyankar holds a graduate degree in Arts (Economics and Commerce) and a postgraduate degree in Law from the University of Mumbai and is a member of The Bombay Incorporated Law Society.

- M

- C

- M

Sujal Shah

Mr Sujal Shah is a Director of the Company since October 2023. He is a Founding Partner at SSPA & Co. He contributed to drafting valuation standards for the Institute of Chartered Accountants of India and has authored numerous valuation-related papers.

Mr Shah holds a graduate degree in Commerce from the University of Mumbai and is a Member of the Institute of Chartered Accountants of India.

- C

- M

Praveen Kadle

Mr Praveen Kadle is a Director of the Company since May 2024. He is the Managing Director of Prachetas Capital Pvt Ltd. He has held various senior positions in Tata Group.

Mr Kadle holds a graduate degree in Commerce from the University of Mumbai. He is a Member of the Institute of Chartered Accountants of India, the Institute of Cost and Management Accountants of India and the Institute of Company Secretaries of India.

Padmaja Chunduru

Ms Padmaja Chunduru is a Director of the Company since January 2025. She was the Managing Director and Chief Executive Officer of National Securities Depository Ltd and the Managing Director and Chief Executive Officer of Indian Bank. She has held various senior positions at State Bank of India.

Ms Chunduru holds a postgraduate degree in Commerce from Andhra University.

- M

Vivek Gadre

Mr Vivek Gadre joined the Company in June 1988 and is a Whole-time Director since January 2025. He is currently the President, Corporate Strategy of the Company.

Mr Gadre holds a graduate degree in Chemical Engineering from Indian Institute of Technology, Delhi and a postgraduate diploma in Management from Indian Institute of Management, Calcutta.